The Silence is Deafening: Two weeks into Kuminga’s Restricted Free Agency

Two weeks into restricted free agency, Kuminga remains unsigned — and the market has gone quiet. This article breaks down how the Warriors’ cap structure, exception mechanics, and limited external pressure give them a very dominant posture in negotiations.

Sections:

I. Current Cap Position

II. GSW’s Potential Guardrails

III. How might this be dictating the Kuminga negotiations?

IV. At what point does Kuminga take the Qualifying Offer? And what would that look like for the Warriors’ long-term cap sheet?

V. Conclusion

I. Current Cap Position

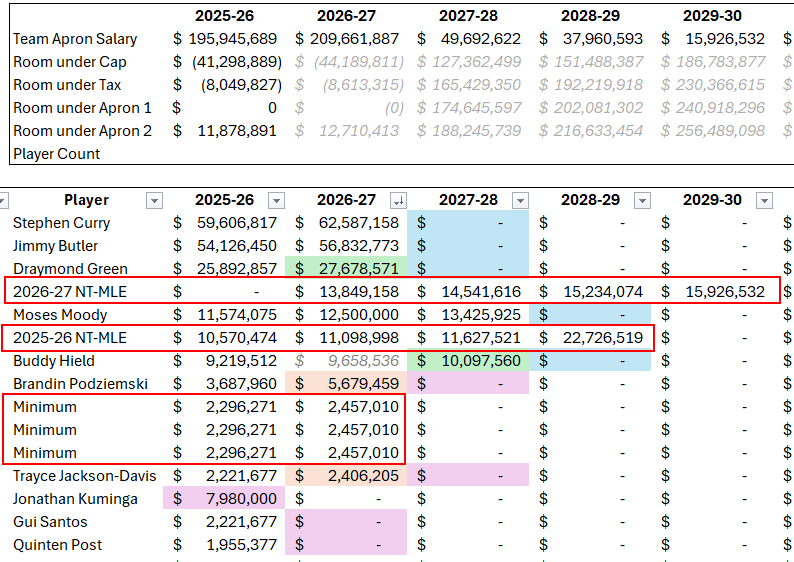

As of this posting, the Warriors' current cap sheet is as follows:

Given how CBA-mature the Warriors' cap sheet is within the lifecycle of a roster, the Warriors are unlikely to be a First Apron Team or lower for the next two seasons. This means that the best roster mechanics available to them for the next two seasons are: (i) the Taxpayer MLE ("T-MLE"); (ii) Minimum Player Salary ("Minimums"); (iii) acquisition through the Aggregated Standard TPE; and (iv) signing drafted players through the Rookie Scale or Second Round Pick Exception. Utilizing (i) or (iii) will hard cap them at the Second Apron.

This article will focus on how preservation of the first two exceptions affects the structure of any potential Kuminga contract.

II. GSW's Potential Guardrails

As noted above, the Warriors will likely need to rely on some combination of Minimums and the T-MLE to (i) reach the minimum roster count and (ii) upgrade the roster for Curry, Draymond, and Jimmy's ("Jimmurrymond") last two seasons under contract.

In order to preserve: (i) all of the 2025-26 T-MLE @ $5.684M; and (ii) three Minimum roster slots (up to $6.889M together), the Warriors will need to sign Kuminga to $24,744,699 or less for 2025-26. That position is displayed here:

In order to preserve: (i) all of the 2026-27 T-MLE @ $6.082M (projected); and (ii) four Minimum roster slots (projected up to $9.828M together), the Warriors will need to ensure Kuminga's 2026-27 cap hit is $23,150,066 or less. That position is displayed here:

It is important to note that all 2026-27 Salary Cap figures are based on a loose projection; however, for the sake of exercising this line of analysis in full, we will operate as if it is locked in.

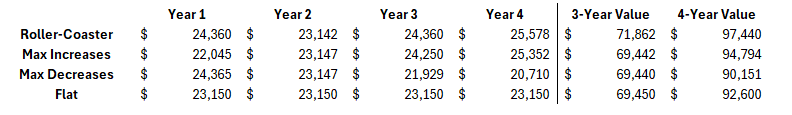

Within these two self-imposed restrictions above, we can assume that the Warriors' "operational max" is:

$24.744M (16%) for 2025-26; and

$23.150 (14%) for 2026-27.

If we adhere to that 2026-27 value, (which, again, I would advise is a must given the Warriors limited roster mechanics) a three or four year "operational max" for Kuminga would look like the following four contracts:

1. Variable Rate/"Roller-Coaster" Structure

This structure is unique and relatively-uncommon in the NBA; it starts high in Year 1, dips in Year 2, only to increase in both Year 3 and Year 4. This structure has the advantage of getting Kuminga the most value possible whilst adhering to the Warriors' cap restrictions. However, no matter how clever this structure may be, the benefit of this structure is nullified if the Warriors are not willing to pay Kuminga approximately $24M AAV (We will discuss Kuminga's market in the next section).

2. Max increases

This structure is the most common in the NBA; with a maximum raise being applied each year. The appeal of this structure is that it will have the lowest Year 1 cap hit of any of the four structures. Given that the Warriors are a Repeater team well into the Fourth Bracket, any dollar saved from this year's Tax Bill will likely be well received by GSW ownership.

3. Max Decreases and Flat Structure

In a vacuum, flat structures and especially decreasing structures will always pique my interest, let alone with a multi-year projection of consistently strong Salary Cap growth we anticipate. However, for the Tax reasons stated above, I just cannot see the Warriors entertaining either of these structures unless that first year was lower than anything Kuminga would reasonably settle for.

Given that Kuminga's likely value is less than $24M AAV at this juncture, and that the Warriors will likely prioritize minimizing their cap hit in 2025-26, Kuminga's operational max would be $22,045,000 for 2025-26, resulting in a maximum value of $69,442,000 for 3-Year deal, and $94,794,000 for a 4-Year deal.

III. How might these guardrails be dictating the Kuminga negotiations?

The only reason we have gotten this far in the analysis without mentioning Kuminga’s actual valuation is because the Warriors are in a market of one; they hold all the cards. While Kuminga may or may not have rejected a $30M AAV extension last summer -- the fact that there are effectively zero Room Teams, over two weeks into Free Agency, and we are without a Kuminga update -- I cannot imagine the tenor of the negotiation room being anything but tense, with both sides a world apart on valuation.

On the one hand, we have the Warriors who are probably the only bidder left, and they have a mountain of valid, yet self-imposed long-term restraints. And on the other we have Kuminga who has continually bet on himself and his valuation.

With this leverage in mind, if I were the Warriors I would consider opening with the following contractual comps:

`24 Obi Toppin ($58M/4, Y1%: 9.23, Max Increases YoY)

`11 Wilson Chandler ($31.73/5, Y1%: 9.50, Increases YoY)

`23 Grant Williams ($53.341/4, Y1%: 9.12, Increases YoY)

A 4-Year Deal starting at 9.25% with max increases in 2025-26 would be $63.173M/4 ($15.8M AAV).

Now this is quite a far cry from what Kuminga may feel he is worth, but the Warriors negotiation posture is very strong at this juncture and this offer reflects that leverage.

Obi Toppin and Wilson Chandler demonstrate there is market precedent to pay these 'mid-to-high rotation athletic forwards who haven't been able to hit the 3 at league-average’ around 9.25%.

And even a player like Grant Williams, who had less of an impact on the box score but a larger role with a very deep Boston team, was only paid 9.12% on a Sign & Trade (while not an apples-to-apples comparison, the Mavericks also gave up an unprotected first round pick swap and two second round picks).

While these comps are quite unflattering and fairly shallow in analysis, I am being intentionally curt here as I want to reiterate that this line of analysis is far less relevant when there is only one bidder. And this triage creates a solid foundation for an opening offer.

Additionally, (just to be clear: this is pure exericise, none of this would resonate with Kuminga) this contract would be a great demonstration of roster management. He gets paid more than Moody and Hield, but less than Draymond; the Warriors retain their Second Apron exceptions; and there is a chance the 2026-27 cap hit will be within the 2026-27 NT-MLE (projected to be $15.091M with a 7.0% increase) which would drastically increase the number of potential trade partners in 2026-27.

Of course, if you're Kuminga, none of that matters. But there are ways to capitalize on what little leverage he has. For example, if Kuminga relents his position and comes down to around $20M AAV (assuming he started at $25M+ AAV), he could try to parlay that concession into a 15% max Trade Kicker and/or a Player Option in the third year. His posture might boil down to an acknowledgement that he has been trying to leave and the Warriors have actively tried to trade him to no avail. But, with an extremely marketable contract like the above, that might change -- and if I was Kuminga I would expect some of the value I left on the table in these negotiations to be paid if/when I am finally moved. This would also manufacture a bit of leverage as any Trade Kicker would be paid by the Warriors, indirectly rebalancing the final guaranteed figure; however, a vested Trade Kicker does affect salary matching for trade purposes.

A vested Player Option would get him back on the market as soon as possible. A Player Option in 2027-28 would get Kuminga into the Unrestricted pool when the cap is projected to be $177M, and a 4-Year deal starting at 17.0% would be worth $130M with 5% raises.

A Player Option in 2028-29 would put Kuminga back on the unrestricted market with seven Years of Service, qualifying him for the 30% max.

With this mini mock negotiation and all of the cap analysis above, I would anticipate negotiations settle around 3 Years with an AAV of $19M - $21.5M. Those figures would look like:

If I was the Warriors I would consider adding a Year-3 Player Option only around that ~$16M AAV range (with the thinking being that it would be a highly tradeable two year deal), and I would imagine a Trade Kicker is off the table unless you get south of that range.

Ultimately, I am not sure how realistic this range is, see next section.

IV. At what point does Kuminga sign his Qualifying Offer? And what would that look like for the Warriors long-term cap planning?

While rarely accepted, Kuminga's $7.98M Qualifying Offer remains his strongest pressure point. If negotiation postures are actually as distant as I have explored in this analysis, I imagine Kuminga is wondering when it's worth it to bet on himself -- again -- and double-down to chance it all for Unrestricted Free Agency in 2026-27. In the past five years, Denzel Valentine is the only player (out of 26 players ) to have signed his Qualifying Offer (following that season he signed a Minimum, a Ten-Day, and an Exhibit 10). While signing the Qualifying Offer may be rare, Kuminga’s unrestricted value in 2026 could surpass that 20% mark if Kuminga realizes some of his potential this season.

However, assuming Kuminga is still holding out for $30M+ AAV, and assuming the Warriors are hovering around that $16M - $19M AAV range - I would not be surprised if we end up seeing him take the Qualifying Offer. That is illustrated here:

If Kuminga were to sign his Qualifying Offer, the Warriors would unlock $10.570M of the NT-MLE in 2025-26, and approximately $13.849M of the 2026-27 NT-MLE. For context, these were some of the NT-MLE recipients this Offseason: Dennis Schroeder, Caris LeVert, Dorian Finney-Smith, Davion Mitchell, Luke Kennard, Luke Kornet, Ty Jerome, & Brook Lopez.

GSW would certainly lament the team control of a multi-year deal, but unlocking a majority of the NT-MLE for the next two seasons would be a decent consolation prize. And ironically, a Sign-and-Trade in 2026 -- where the league has had a whole year to prepare, and Kuminga has had another year to play, grow, and demonstrate his value -- may not be the worst thing for both sides.

V. Conclusion

Given the lack of Room bidders around the league, and the Warriors likely cap restraints, I would anticipate the Warriors go no higher than 3 Years with an AAV of $19M - $21.5M.

Given Kuminga’s strong posture in his own potential and market-value, I am not certain he would settle for this and I have to imagine he would be strongly entertaining signing the Qualifying Offer and become an Unrestricted Free Agent in 2026, which projects to have greater Room.

Thank you for reading! I hope you enjoyed this article. If you would like to receive my cap consulting portfolio or schedule a time to discuss a project, please provide your information below.